|

Corporate Presentation; Anderson Gold Trend - Gold Camp in the Making, Carleton West - High-Grade Keno Hill Silver; October 13, 2023

Executive Summary; October 16, 2023 March 12, 2024

Mayo Lake Minerals Updates Merger with Westmountain Gold August 17, 2023 Mayo Lake Minerals Signs Letter of Intent with WestMountain Gold NEWS

|

Mayo Lake Minerals Inc.

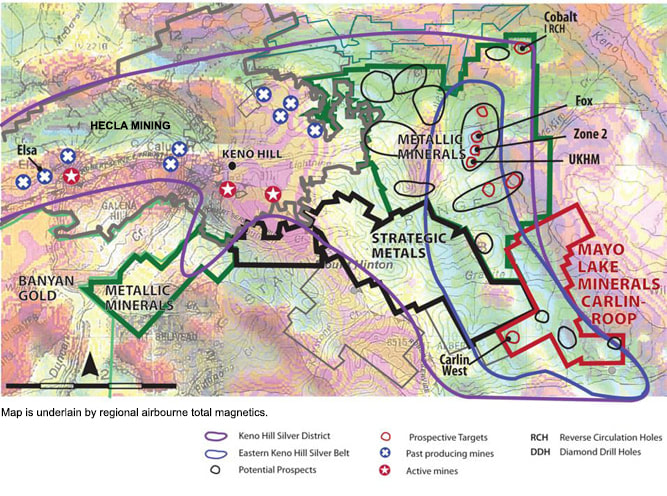

Mayo Lake Minerals Inc. (MAYO) is a public company listed on the Canadian Securities Exchange (CSE) under the symbol MLKM that owns a 100 per cent interest in five claim blocks, presently consisting of 1253 quartz claims, in the Mayo Mining District of the Yukon. These claim groups all lie within the Tombstone Plutonic Belt of the Tintina Gold Belt (Figure 1). In 2019, it became apparent that the Carlin-Roop Silver Property boasted the highest prospectivity for high-grade Keno Hill Style Mineralization. The ore in the Keno Hill Silver District consists of high-grade Keno Hill Style Mineralization.

MAYO acquired its claim groups in 2011 because of:

In spite of MAYO’s exploration was limited by funding between 2012 and 2016, it did receive positive results from its early geochemical and geophysical surveys and used these results to direct further exploration: detailed geochemical grid surveys, ground geophysics, limited trenching and scout drilling. Scout drilling in 2017 on the Anderson-Davidson claim group allowed Mayo to confirm a 10 kilometer-long gold trend.

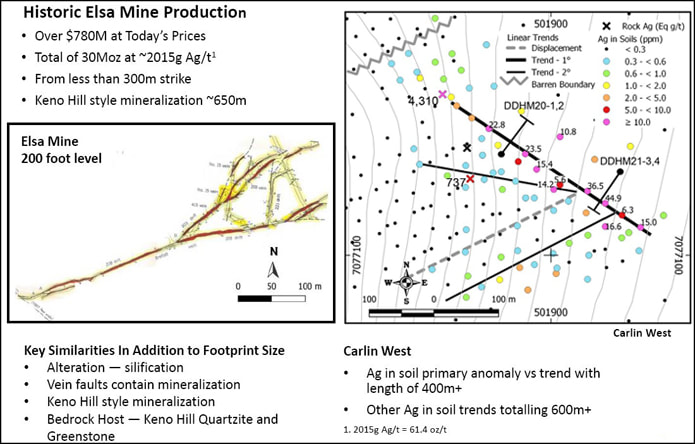

Beginning in 2019, the high prospectivity of the Carlin-Roop property for silver was realized from the presence of a very anomalous, 600m plus long soil anomaly related to structural elements common to the Keno Hill Silver District. Shallow IP and a limited 2 hole diamond drill program of 205m identified Keno Hill Silver Mineralization in two zones, confirming its potential for ore-grade silver deposits (Figure 2). Soil sampling, geophysics and the presence of an intrusive at Trail-Minto indicates the potential for a deposit similar to that at Victoria Gold’s Eagle Mine. A broad 2 km by 3 km magnetic low with associated gold and base metal anomalies points to a significant subsurface multi-element subsurface deposit(s) at Edmonton. Gold in soil anomalies at Cascade are present in a tectonized and over thickened rock sequence. All of MLM’s claim groups are located close to road infrastructure, with the three largest of them directly accessible by road. The nearby Wareham Dam has the potential to increase capacity to power more nearby projects. The Keno Hill Silver Camp

'The Yukon’s Keno Hill Camp (KHSC) was not only Canada's second largest primary silver producer and one of the richest Ag-Pb-Zn vein deposits ever mined in the world, it was also one of the mainstays of the Yukon economy from the 1920s until the early 1960s. It produced more wealth than the Klondike, one of the richest placer gold districts in the world.

The KHC is defined by most geologists as a belt of high-grade silver-lead-zinc rich vein deposits (Keno Hill Style Mineralization; KHSM) approximately 21 km long and 2 to 6.5 km wide that crosses parts of Galena, Keno and Sourdough Hills north and east of Mayo Lake in the Yukon. The camp contains 16 important deposits, defined as those that produced over 15.55 t (500,000 oz) of Ag, another 19 that shipped smaller amounts to a smelter, and 35 minor occurrences. The KHSC produced a total of 214M Oz of silver between 1913 and 1990 with the Elsa Mine being the second largest producer at 30M Oz., which at today’s prices is approximately US$780M.' ¹ Mining ended in the KHSC in 1990 because of falling silver prices and a shortage of defined resources needed to sustain operations. Subsequently, the government contracted a company to do an environmental clean-up of the KHSC. The clean-up agreement allowed the company to undertake exploration which subsequently outlined enough resources to commence mining in 2020. Hecla Mining was created to complete the exploration and mining operations. Hecla expects to mine 1.44 million tonnes of ore grading an average of 1,035g AgEq/t over the next 10 years. It continues to outline more high-grade ore.

Recently, three companies with the largest holdings focused on silver, Metallic Minerals, Alianza Minerals and Mayo Lake Minerals have expanded their exploration programs during the last two years. Metallic Minerals’ exploration was completed in the central and eastern sector of the Keno Hill Silver District (KHSD), Alianza Minerals’ the far west extent of the KHSD and Mayo Lake Minerals’ the southeastern sector ² (Figure 2 and Figure 3). Mayo Lake Minerals and Metallic Minerals’ work in the eastern sector of the KHSD have demonstrated that KHSM (high-grade silver) is present in this underexplored part of the KHSD. Mayo Lake Minerals have noted similarity in the footprint size and geology of the productive Elsa mine and Mayo’s Carlin West discovery (Figure KH1). ¹ Excerpts from Great Mining Camps of Canada 1.The History and Geology of the Keno Hill Silver Camp, Yukon Territory; R. J. (Bob) Cathro (2006). ² The KHSD is a slightly expanded version of the KHSC. |

|

MAILING ADDRESS

Mayo Lake Minerals Box 158, Carp On K0A 1L0 |

|